Aim to achieve seamless transactions with your customers to foster trust and build better relationships by digitizing your efforts through modern solutions and taking it a step further by incorporating workflow automation in your method. Get robust AR automation software and efficiently go through this process to maximize business results.

13+ AR Automation Software

1. Bill.Com

2. Invoiced

3. Billtrust

4. Synder

5. Tesorio

6. EBizCharge

7. Gaviti

8. Accounting Seed

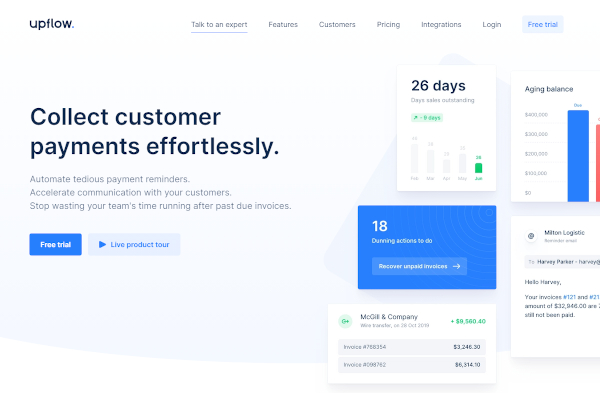

9. Upflow

10. YayPay by Quadient

11. Lockstep Collect

12. Versapay

13. PDCflow

14. Gravity Software

What Is AR Automation Software?

AR automation software refers to the digital solution that software developers designed to help businesses automate the processes of invoicing and payment processing. Having this software solution means that you can access the tools you need in taking the step to shift to digital methods for collecting cash on a centralized platform. Also, it has a database that functions to store and organize electronic documents and relevant paperwork for managing accounts receivable.

In addition, this accounts receivable automation software simplifies payment tracking tasks and sends automated reminders to ensure that your customers observe deadlines and understand your credit practices for a smoother financial transaction.

Benefits

This technology will help you establish your online presence, improving accessibility and data transparency. Also, it heightens database security and allows you to employ more productive approaches to recording and documenting receivables. Using this software will also let you experience an increase in accuracy and minimize delays in your credits and collection tasks.

Features

Checking the interface design of digital solutions in the software market and evaluating whether or not your team can understand their importance and learn to integrate them into your daily operations is only one step in deciding on the software of our choice. Considering how your choice can affect the success of your processes, you should ensure to look out for factors such as their subscription plans, service offerings, and their compatibility with the size of your organization. The following features are also part of the checklist of elements you should look into:

- Credit card processing tools

- Online payment gateways

- Claims management functionalities

- Data analytics and reporting tools

- Billing & invoicing capabilities

- Document generation and management features

- Cash flow management functionalities

- Live chat platform integration

- Third-party applications integration

Top 10 AR Automation Software

1. YayPay by Quadient

Debt collection tools and accounting integration are features you can use in this software. They have generated a revenue of 1 billion dollars and have employed 5,693 people.

2. Bill.com

This accounts receivable software has expense tracking and collections management tools. They have 124.7 million dollars in generated revenue and have 959 employees.

3. Billtrust

With this billing & invoicing software, you can streamline dunning management and access a billing portal. Billtrust has employed 580 people and has 75.4 million dollars in revenue.

4. Accounting Seed

Accounting Seed is an accounting platform that provides users with data extraction and approval process control features. They have 47 people in their team and have 6.8 million dollars in generated revenue.

5. Tesorio

With Tesorio, you can improve your check processing and aging tracking practices. They have 51 employees working for them and have 6.6 million dollars in revenue.

6. Gaviti

Gaviti is a debt collection software with digital tools for contact management and has automated notices. They have estimated revenue of 5 million dollars and have 35 employees in their team.

7. EBizCharge

EBizCharge is a payment processing software with functionalities for fraud detection and electronic signature capabilities. They have a generated revenue of 5 million dollars and have over 25 employees.

8. Synder

With this accounting software, you can access the functionalities necessary for channel management and bank reconciliation. Its developer, CloudBusiness, has 2.1 million dollars in generated revenue and has 24 people working for them.

9. Invoiced

This digital solution offers capabilities for online invoicing and a receivables ledger. They have a revenue of 1.2 million dollars and have 15 people on their team.

10. Upflow

Functionalities for invoice management and data security are accessible in this software. They have 742.3 thousand dollars in revenue and have 35 employees working for them.

FAQs

What are accounts receivable?

Accounts receivable refers to the amount of money that your company is about to receive from clients who have debts from purchasing your services or goods. Businesses issue invoices to record transactions and notify clients of the exact amount they should pay and the particular period required for the payment.

What are tips for improving your collection processes?

One of the best practices for collecting payments is to provide multiple payment processing options to your clients. Doing so eliminates the hassle and makes it more convenient and secure for both parties to proceed with the transaction. Also, use messaging channels with live chat capabilities for better and more consistent negotiations.

What are the advantages of automating your AR management tasks?

Gaining the ability to automatically complete the lengthy and manual processes for managing accounts receivable allows businesses to cut costs and save time. Also, it makes way for faster payments which enhances the customer experience. Accounts receivable management automation also helps your finance team get their hands on richer data, aiding them in making decisions backed by data and pivoting strategies based on insights gained from this agile method.

Minimize the effort necessary for the taxing processes of delivering invoices, reminding clients, and processing their payments by employing innovative modern solutions. Welcome new heights in your business and increase your operational efficiency with the best AR automation software at your disposal. Get yours as early as now from the key players in this article.

Related Posts

10+ Best Chemical Software for Windows, Mac, Android 2022

12+ Best Vulnerability Scanner Software for Windows, Mac, Android 2022

4+ Best Bundled Pay Management Software for Windows, Mac, Android 2022

10+ Best Trust Accounting Software for Windows, Mac, Android 2022

10+ Best Patient Portal Software for Windows, Mac, Android 2022

13+ Best Virtual Reality (VR) Software for Windows, Mac, Android 2022

12+ Best Bed and Breakfast Software for Windows, Mac, Android 2022

15+ Best Resort Management Software for Windows, Mac, Android 2022

14+ Best Hotel Channel Management Software for Windows, Mac, Android 2022

12+ Best Social Media Monitoring Software for Windows, Mac, Android 2022

10+ Best Transport Management Software for Windows, Mac, Android 2022

10+ Best Other Marketing Software for Windows, Mac, Android 2022

10+ Best Top Sales Enablement Software for Windows, Mac, Android 2022

8+ Best Industry Business Intelligence Software for Windows, Mac, Android 2022

10+ Best Insurance Agency Software for Windows, Mac, Android 2022