A lot of people invest in various things, Insurance, healthcare, education, real estate, and more. Investments can be risky, and investors sometimes find it hard to trust financial institutions. That is why investments require high-quality portfolio management to ensure flawless records, compliance, and meeting policies. You will need investment portfolio management software.

26+ Investment Portfolio Management Software

1. Seeking Alpha

2. Riskalyze

3. Morningstar Office

4. Altair

5. Backstop Solutions Suite

6. SimCorp Dimension

7. Morningstar

8. Morningstar Direct

9. EMoney

10. Geneva

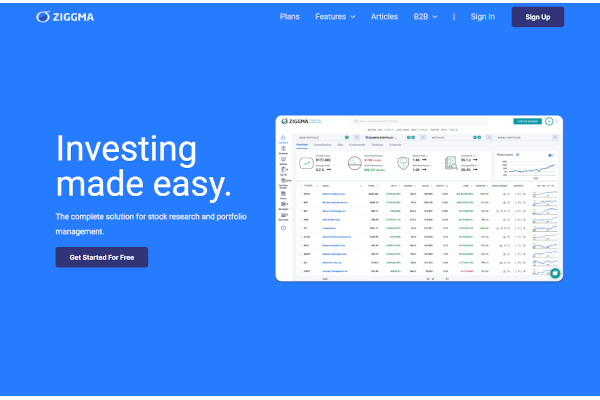

11. Ziggma

12. Fi360 Toolkit

13. HiddenLevers

14. Advent Portfolio Exchange

15. Croesus Advisor

16. Pershing Financial Services

17. EquatePlus

18. MProfit for Accounting

19. Stratifi PRISM

20. Advent Genesis

21. Allvue

22. Assetmax

23. Betterment

24. Dynamo

25. EquityEffect

26. Fidessa

27. ILEVEL

What is Investment Portfolio Management Software?

Managing investment and portfolio is a critical job. The trust your clients give and will give you depends on your management of those two primary factors. Investment and portfolio involve multiple assets. One mistake can lead to serious errors. Since manual process consumes too much effort and time and can give inaccurate data analysis, it is not enough. You will need a solution such as using investment portfolio management software. This software provides multiple advanced features and functionalities to help you record, analyze, transact, and process critical factors. Investment portfolio management software improves communication and productivity, resulting to enhance decisions and strategic planning.

Benefits

Undeniably, manual methods have limitations. Aside from being a lot of work, it can get hectic, which is frustrating, leading to a loss of focus and, eventually, a loss of direction. With investment portfolio management software on hand, you can boost the speed of your operations. With this tool, you can prevent overlooks and mistakes, showing promising management to your clients.

Features

Various technology firms developed investment portfolio management software. Features and functionalities can differ depending on the platform. Software is indeed contributive. However, some software may not meet your expectation or be helpful to your management. That is why, before purchasing software, it is critical to research and evaluate its capabilities. There are websites writing content about the pros and cons of software you can review. You can also try free versions and trials to platforms that offer them. Below are features you should consider:

- Accounting

- Benchmarking Tools

- Bonds / Stocks

- Client Management

- Client Portal

- Commodity Futures

- Compliance Tracking

- Fund Management

- Collaboration Tools

Top 10 Investment Portfolio Management Software

1. Altair

Altair includes visualization, data cleaning, consolidation, data structuring, diverse extraction points, and more valuable features. Altair has annual revenue of $458.1 million and 3,159 employees.

2. SimCorp Dimension

SimCorp Dimension from SimCorp includes fund management, performance metrics, portfolio accounting, tax management, and more helpful features. SimCorp has annual revenue of $293.3 million and 2,023 employees.

3. Seeking Alpha

Seeking Alpha is a stock market analysis tool that can help you manage your portfolio. Seeking Alpha is a fun, dynamic, family-like environment full of smart, innovative, and entrepreneurial people. Seeking Alpha has annual revenue of $107.9 million and 744 employees.

4. EMoney

EMoney includes risk management, modeling and simulation, benchmarking, compliance tracking, and more advanced features. Emoney has annual revenue of $87.1 million and 670 employees.

5. Riskalyze

Riskalyze includes customizable reporting, market analytics, client portal, investment accounting, and more advanced features. Riskalyze has annual revenue of $26.5 million and 204 employees.

6. Backstop Solutions Suite

Investment consultants, pensions, funds of funds, family offices, endowments, foundations, private equity, hedge funds, and real estate investment firms use Backstop’s industry-leading cloud-based productivity suite. Backstop Solutions Group has annual revenues of $26 million and 200 employees.

7. Geneva

When managing and accounting for different types of instruments, Geneva eliminates the need for separate systems or spreadsheet workarounds. Geneva has annual revenue of $13 million and 107 employees.

8. Morningstar Office

Morningstar Office includes client management, financial analysis, portfolio accounting, portfolio rebalancing, and more innovative features. Morningstar has annual revenue of $0.6 million and three employees.

9. Morningstar

Morningstar Direct facilitates informed decision-making by providing access to new and emerging data, independent research, portfolio analytics, and customized reporting. Morningstar has three employees and yearly revenue of $0.6 million.

10. Morningstar Direct

Morningstar Direct includes risk analysis, independent insights, centralized data, sustainability risk mitigation, and more contributive features. Morningstar employs three people and generates $0.6 million in revenue per year.

FAQs

What is investment management?

Investment management is the process of organizing and analyzing investment factors. Investment involves numerous critical components that require high-quality management. Investors do not invest in your firm only because they want to, but because they trust you. You can expect good results, excellent initiatives, and customer satisfaction if you use good management tactics.

What is portfolio management?

Portfolio management is the process of risk management, analyzing assets, risk tolerance, etc., all to ensure return on investments. A portfolio involves different types of assets you included in your investments. You can manage your portfolio or hire experts to evaluate your portfolio from time to time. Portfolio management has the purpose of reaching your investment goals.

Why is software beneficial?

Nowadays, technology drives the world to evolve, especially in the business industry. Regardless of the size of the business, the software is used to improve business factors. The software delivers features that allow firms to improve productivity and customer service. The software provides promising results leading to an ever-improving business.

Managing investments and portfolios is not a simple matter. Manual methods would not suffice to reach your objectives since it has multiple frustrating possibilities. Technology brings advancements to the world; it will be wise to make use of it. Improve your management with investment and portfolio management software. Ensure quality assurance, customer satisfaction, and operational efficiency with software.

Related Posts

10+ Best Chemical Software for Windows, Mac, Android 2022

12+ Best Vulnerability Scanner Software for Windows, Mac, Android 2022

4+ Best Bundled Pay Management Software for Windows, Mac, Android 2022

10+ Best Trust Accounting Software for Windows, Mac, Android 2022

10+ Best Patient Portal Software for Windows, Mac, Android 2022

13+ Best Virtual Reality (VR) Software for Windows, Mac, Android 2022

12+ Best Bed and Breakfast Software for Windows, Mac, Android 2022

15+ Best Resort Management Software for Windows, Mac, Android 2022

14+ Best Hotel Channel Management Software for Windows, Mac, Android 2022

12+ Best Social Media Monitoring Software for Windows, Mac, Android 2022

10+ Best Transport Management Software for Windows, Mac, Android 2022

10+ Best Other Marketing Software for Windows, Mac, Android 2022

10+ Best Top Sales Enablement Software for Windows, Mac, Android 2022

8+ Best Industry Business Intelligence Software for Windows, Mac, Android 2022

10+ Best Insurance Agency Software for Windows, Mac, Android 2022