Processing and providing loans involves plenty of complicated tasks. If you find yourself nodding to this statement, you are guilty of one of two things. You did not start going digital with your processes. Two, you equipped the modern solution that does not fit your needs. Either way, good thing you are here. Find the loan management solution that will serve you to achieve your objectives and goals in this article as early as now.

10+ Best Loan Management Software

1. FinCraft

2. FusionONE

3. FinnOne Neo

4. The Mortgage Office

5. Nortridge

6. AutoCloud

7. Calyx Software

8. LoanPro

9. LOAN SERVICING SOFT

10. FINFLUX

11. HES FinTech

What Is Loan Management Software?

Loan management software refers to the modern solution that allows loan agencies to automate processes in the loan lifecycle. It offers end-users the capability to process applications digitally and streamline processes for gathering essential information from clients to determine their credibility. This software also uncomplicates tasks for calculating charges and managing interest rates.

Also, it has collections management functionalities that record payment history and track interactions of employees and lenders. Additionally, the loan management solution has data analytics tools to determine the success of loan services and monitor cash flow.

Benefits

Securing a loan management solution will help you shift your loan management efforts to digital platforms seamlessly. It accelerates transactions and makes them paperless, enhancing the overall experience of the lenders. This software reduces the possibility of human error and also minimizes delayed payments, making your workforce more efficient and boosting employee productivity.

Features

When you look for the software to equip in the software market, you will not only see two or five software to consider. You can find pages and pages of results for solutions that provide an extensive list of services and specializes in varying aspects. That said, saying that deciding on your software can get overwhelming is not an overstatement. Approach your selection process carefully by looking into essential elements. The following are features that top-performing loan management solutions offer:

- Loan origination tools

- Loan servicing capabilities

- Document amendment functionalities

- Debt collection features

- Client information management tools

- Data analysis and reporting capabilities

- Credit assessment tools

- Risk management tools

- Workflow automation functionalities

- Financial management tools

- Customer communications management features

Top 10 Loan Management Software

1. FinCraft

This banking systems software has functionalities for transaction monitoring and securities management. Its developer, Nelito Systems, has 1,200 employees and has 253 million dollars in revenue.

2. FinnOne Neo

With this lending management solution, you can streamline processes for overseeing accounting and corporate banking. They have 1,840 employees on their team and have 70.4 million dollars in generated revenue.

3. Calyx Software

Calyx Software is a platform that provides users with contact management and electronic signature features. They have employed 158 people and have a revenue of 42 million dollars.

4. FINFLUX

Online application management and customer management tools are features you can use in this loan origination software. They have generated a revenue of 21 million dollars and have employed 97 people.

5. Nortridge

With Nortridge, you can simplify the complexities involved in asset lifecycle management and exposure management. They have a generated revenue of 10 million dollars and have 80 employees working for them.

6. The Mortgage Office

With this mortgage software, you can access credit reporting capabilities and pipeline management tools. They have 21 people working for them and have 8 million dollars in revenue.

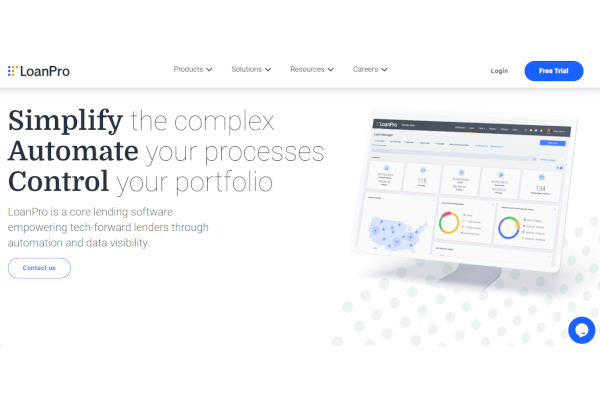

7. LoanPro

LoanPro is a loan servicing software with digital tools for investor management and student loans management. They have a revenue of 5.4 million dollars and have 26 employees working for them.

8. FusionONE

This accounts payable software has recurring billing and cash management tools. They have 5 million dollars in generated revenue and have 31 people on their team.

9. AutoCloud

AutoCloud is a digital solution with audit trail and lead management features. Its developer, AllCloud Enterprise Solutions, has over 25 employees and has 5 million dollars in generated revenue.

10. LOAN SERVICING SOFT

Functionalities for automatic funds distribution and a client database are accessible on this platform. They have six people on their team and have 1.04 million dollars in revenue.

FAQs

What is the loan origination process?

Loan origination happens when clients submit their application for a loan and the agency processes it. It involves collecting details such as income, credit history, and other necessary information to make an informed decision in processing the loan. Loan origination also includes steps taken from managing the application to the disbursal of the fund.

What is the role of CRM in loan management?

Having a CRM tool helps you take a data-centric approach to ensure customer satisfaction. With this digital solution, you can track transactions and improve access to needed loan information to make your loan services personalized. Also, it provides marketing automation capabilities to expand audience reach and provides messaging tools and customer engagement tools to establish and nurture relationships with lenders.

What are the benefits of loan automation?

Automating your loan processes help you identify and mitigate risks more effectively. Also, it improves data integrity to avoid complications in the procedure and eliminates the possibility of duplication of records. Loan automation also helps in identifying and exposing fraudulent behaviors and detecting delinquency. Having the capability for scalability to meet changing demands is also a benefit of incorporating automation in your operations.

Speed up your processes and improve brand reputation by having the appropriate solution in your toolkit to meet customer demands and increase operational efficiency. Power up your loan processes, equip your employees with the tools they need to provide a quality experience in multiple touchpoints and boost business profitability by securing the best loan management software for you as early as now.

Related Posts

10+ Best Chemical Software for Windows, Mac, Android 2022

12+ Best Vulnerability Scanner Software for Windows, Mac, Android 2022

4+ Best Bundled Pay Management Software for Windows, Mac, Android 2022

10+ Best Trust Accounting Software for Windows, Mac, Android 2022

10+ Best Patient Portal Software for Windows, Mac, Android 2022

13+ Best Virtual Reality (VR) Software for Windows, Mac, Android 2022

12+ Best Bed and Breakfast Software for Windows, Mac, Android 2022

15+ Best Resort Management Software for Windows, Mac, Android 2022

14+ Best Hotel Channel Management Software for Windows, Mac, Android 2022

12+ Best Social Media Monitoring Software for Windows, Mac, Android 2022

10+ Best Transport Management Software for Windows, Mac, Android 2022

10+ Best Other Marketing Software for Windows, Mac, Android 2022

10+ Best Top Sales Enablement Software for Windows, Mac, Android 2022

8+ Best Industry Business Intelligence Software for Windows, Mac, Android 2022

10+ Best Insurance Agency Software for Windows, Mac, Android 2022