Merchants and other small businesses may find it challenging to keep up with new standards and best practices as the payment processing industry has evolved and become more diverse in recent years. While it does not seem to be especially exciting at first, the convergence of payment transaction processing and accounting software is undeniably one of the most critical of modern standards.

12+ Payment Processing Software

1. Stripe

2. Square Payments

3. Amazon Pay

4. Google pay

5. PayPal

6. PaySimple

7. CyberSource Payment

8. 2CheckOut

9. Venmo

10. Authorize.NET

11. WePay

12. Checkout.com

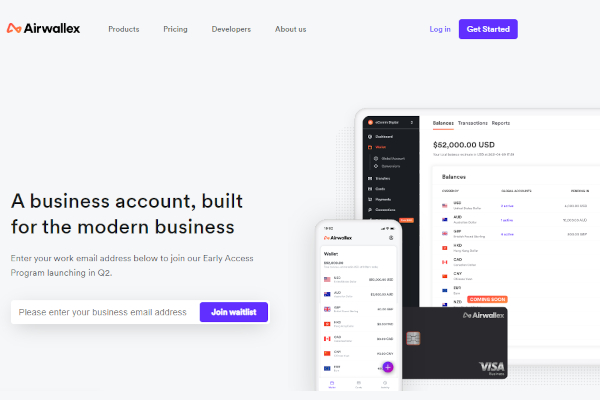

13. Airwallex

What Is a Payment Processing Software?

Payment processing software enables companies to handle a variety of business-to-business transactions. This form of software is used by businesses to manage payments collected from consumers and made to suppliers. Payment processing software is beneficial to any company that accepts payments other than cash. Accounting departments typically use this program to ensure that payments are submitted on time, and that payment mistakes are avoided.

How to Start a Payment-Processing Company?

Creating a separate sales organization, the easiest way for you to break into the payment processing industry is to invite merchants to subscribe to you and submit their credit cards. However, the market is competitive, and you regularly compete for business with rival processors. If you want to start a payment processing business, here are a few steps.

1. Create a Business Plan

Plan how you’ll run your business, what services you’ll provide, and how much you’ll charge for each. Determine the size of the sales force and how they will be paid. Make a list of how much money you’ll need to start and run your company, as well as how you’ll get it. Make a marketing strategy for your new company.

2. Collaborate with a Bank

Your transactions must be underwritten, and a Visa/MasterCard bank must handle interbank routing. You can do this by personally approaching banks in your region or representing your preferred market, meeting with bank management, and presenting a business plan that explains how merchant payment services can help the bank cement partnerships with small businesses.

3. Recruit a Sales and Marketing Team

These individuals will be in charge of calling on business owners and soliciting their patronage. The majority are working on commission or a wage plus commission and operate as independent contractors. The manager would have veto power on all sales made by his sales team. It would help if you compensated the sales force enough to keep them operating on your behalf, but not so much that your company ceases to be profitable. Also, a marketing team is essential for promoting your company online and through digital, print, and even broadcast ads.

4. Be prepared

If you need a business loan to get started, you’ll need to present a bank with a professional-looking business plan. If you plan to rent or purchase commercial office space, you’ll need more money to get started, as well as property and liability insurance.

FAQs

What is the procedure for handling payments?

The payment processor sends transaction information to the card associations, communicating the necessary debits to the network’s issuing banks. The value of the transactions is charged to the cardholder’s account by the issuing bank. Funds are deposited into the merchant account by the merchant bank.

What is the procedure for processing credit card payments?

A credit card network collects the credit card payment information from the acquiring processor during the processing phase. It sends the payment authorization request to the issuing bank and then receives the response from the issuing bank.

What exactly is a payment link?

A payment connection is an online payment system in which the retailer generates and shares an online payment request with the customer, allowing them to make instant online payments. For both customers and merchants, accepting payments through link sharing is the simplest and fastest method.

All of this knowledge on payment gateways may be confusing. We understand that choosing the right online payment partner is a critical decision for your business, which is why we built our unified payment platform with the customer in mind. You’ll be able to provide improved online services and frictionless customer journeys to your customers by leveraging a payment solution designed for today’s demanding consumers.

Related Posts

10+ Best Chemical Software for Windows, Mac, Android 2022

12+ Best Vulnerability Scanner Software for Windows, Mac, Android 2022

4+ Best Bundled Pay Management Software for Windows, Mac, Android 2022

10+ Best Trust Accounting Software for Windows, Mac, Android 2022

10+ Best Patient Portal Software for Windows, Mac, Android 2022

13+ Best Virtual Reality (VR) Software for Windows, Mac, Android 2022

12+ Best Bed and Breakfast Software for Windows, Mac, Android 2022

15+ Best Resort Management Software for Windows, Mac, Android 2022

14+ Best Hotel Channel Management Software for Windows, Mac, Android 2022

12+ Best Social Media Monitoring Software for Windows, Mac, Android 2022

10+ Best Transport Management Software for Windows, Mac, Android 2022

10+ Best Other Marketing Software for Windows, Mac, Android 2022

10+ Best Top Sales Enablement Software for Windows, Mac, Android 2022

8+ Best Industry Business Intelligence Software for Windows, Mac, Android 2022

10+ Best Insurance Agency Software for Windows, Mac, Android 2022