4+ Tax Software for Small Business

Venturing into the business world is risk entrepreneurs are willing to take. Doing a business is not a walk in the park, it needs some sort of courage, creativity, time, effort, and money to go through the whole process. Regardless of industries, small businesses—those who started from scratch and those not built by big corporations— got the challenge extra hard. With small businesses, dealing with business operations and business shenanigans are extra challenging, especially in any tax-related situations.

Check on the full article to know more about software that can be used, its benefits, its features, the top 10 software available in the market, and the answers to the frequently asked questions.

1. H&R Block

2. TaxAct

3. TaxSlayer

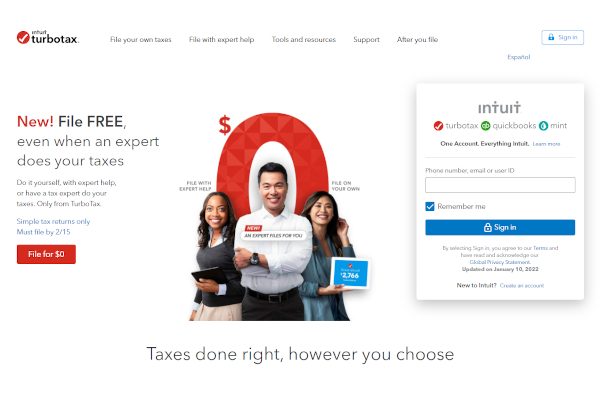

4. TurboTax

5. FreeTaxUSA

What is Tax Software for Small Busines?

Tax is a countrymen’s responsibility to its nation. Individuals pay taxes through the goods and services they consume. Professionals pay their taxes through their payroll taxes. Businesses pay taxes through corporate income taxes and other business-related taxes. This is where Tax Software for Small businesses comes in handy. This software provides tools and solutions for small businesses to comply with their taxes on their own. With the use of this software, tax compliance, returns, and other tax transactions will be a walk in the park. This software allows you to manage your taxes efficiently and in an organized manner.

Benefits

Tax Software for Small Businesses saves you cost and time because you do not have to hire a third party to do the job for you. Using this will allow you to easily keep track of your tax documents and actions. Tax Software for Small Businesses automates and leverages the whole process giving small businesses ease of mind.

Features

Tax Software for Small Businesses is equipped with many different tools, functionalities, and features to maximize its performance. Among these are tax management, accounting and finance tools, document management, and ERP.

There are more benefits and features present on the full list of software products below. Be sure to check on them to find the perfect one for your needs.

Top 10 Software

1. H & R Block

Help is here at H & R Block! This tax preparations service company allows you to find the best tax option for you. H & R Block offers services on any tax-related needs, finance management, and help for small businesses in their tax prep, bookkeeping, and payroll.

2. TaxAct

File for less and get more here at TaxAct! This software offers guidance and ensures quality tax refunds. With TaxAct, you will be able to file easily, accurately, and confidently through their tools: Easy Import, Pro Tips, My TaxPlan, Audit Defense, Refund Transfer, and E-file Concierge.

3. TaxSlayer

Slay your taxes today with TaxSlayer! Filing tax, processing e-file tax returns, managing taxes online? Everything is easy here at TaxSlayer. This software provides you with tools like the fastest tax refund, file on the go through an app, help, and support you need, guaranteed maximum refund, 100% accuracy guaranteed, and zero out of the pocket fees.

4. Turbo Tax

However, you choose, here in Turbo Tax everything is done right! This software offers you three simple options, do your taxes on your own, expert help, and do taxes for you. Turbo Tax is 100% accuracy guaranteed, maximum refund guaranteed, and get the green light to file.

5. FreeTax USA

Do it right, do anything tax for free with FreeTax USA. This software offers free tax filing, online returns, e-filing, and other federal needs. With FreeTax USA, you will be able to ensure maximum guarantee, free federal, 100% accuracy, and many other advantages.

FAQs

What is a small business?

Small businesses are up and growing businesses, they are those who started from scratch and have lesser revenue than other big corporations.

Who uses Tax Software for Small Businesses?

Tax Software for Small Businesses is used by bookkeepers, accountants, accounting teams, and small business owners.

How much is a Tax Software for Small Businesses?

There are many Tax Software for Small Businesses available in the market. Some are priced reasonably given their use, benefits, and features. Others have free trial offerings at a fixed time to help convince you in getting the premium versions, while a few have a free use forever perk.

Small businesses don’t need to be less on anything, they are equally important as big corporations. These businesses are also taxpayers who have a responsibility in the nation. Use any of the software products above to efficiently manage any tax needs of a small business now!

Related Posts

10+ Best Chemical Software for Windows, Mac, Android 2022

12+ Best Vulnerability Scanner Software for Windows, Mac, Android 2022

4+ Best Bundled Pay Management Software for Windows, Mac, Android 2022

10+ Best Trust Accounting Software for Windows, Mac, Android 2022

10+ Best Patient Portal Software for Windows, Mac, Android 2022

13+ Best Virtual Reality (VR) Software for Windows, Mac, Android 2022

12+ Best Bed and Breakfast Software for Windows, Mac, Android 2022

15+ Best Resort Management Software for Windows, Mac, Android 2022

14+ Best Hotel Channel Management Software for Windows, Mac, Android 2022

12+ Best Social Media Monitoring Software for Windows, Mac, Android 2022

10+ Best Transport Management Software for Windows, Mac, Android 2022

10+ Best Other Marketing Software for Windows, Mac, Android 2022

10+ Best Top Sales Enablement Software for Windows, Mac, Android 2022

8+ Best Industry Business Intelligence Software for Windows, Mac, Android 2022

10+ Best Insurance Agency Software for Windows, Mac, Android 2022