Mortgage services are never simple. A mortgage is a big matter that requires multiple critical procedures to reach its objectives. As a lender or an owner of mortgage businesses, you will need digital mortgage closing software to help you perform your lending operations effectively and efficiently. Continue reading below for more.

8+ Digital Mortgage Closing Software

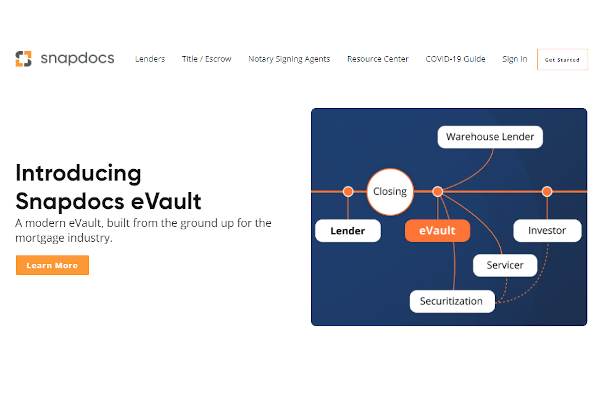

1. Snapdocs

2. DocMagic

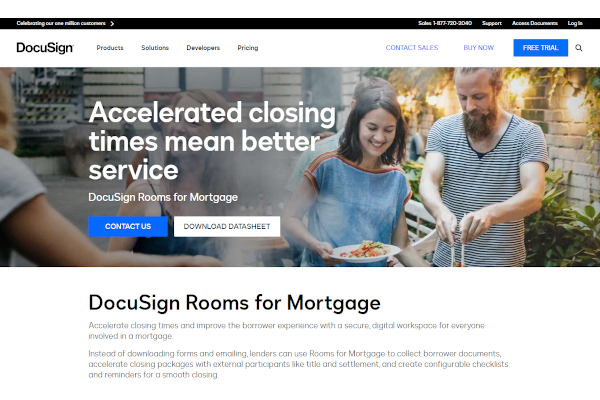

3. DocuSign Rooms for Mortgage

4. AtClose

5. Cloudvirga Enterprise POS

6. EClosePlus

7. Expedite Close

8. Experian Mortgage

9. MortgageHippo

What is Digital Mortgage Closing Software?

A mortgage is a type of loan that focuses on real estate. It helps you get the house you want by lending you the amount you need to purchase your target house. Mortgage operations involve multiple documents and communication to settle the deal. Manual processes are essential. However, it has limitations that can hinder your work. That being the case, experts developed digital mortgage closing software offering multiple advanced features and functionalities that allow you to process critical files and communicate with your clients. This technological tool is contributive as it ensures convenient and cost-effective methods. That way you can make your life easier.

Benefits

As we all know, manual methods are not enough to handle your job flawlessly. Traditional methods are also essential. However, it consumes time and is prone to overlooks. With digital mortgage closing software, you can perform your tasks within a single platform, helping you save time, reduce manual processes and costs.

Features

Features and functionalities are the most crucial factors you have to check before buying or paying a membership fee to a platform. Software is indeed contributive. However, you can’t deny that not all software can meet your expectations. Some of them may specialize features that you might find irrelevant to your operations. For this reason, it is advisable to research the software’s capabilities. There are several websites that write content about software comparison and show user reviews. You can also try the free trials and versions. Below are features you should consider:

- Audit Management

- Auto Loans

- Automatic Funds Distribution

- Branch Optimization

- Business Loans

- Customer Management

- Loan Origination

- Loan Processing

- Business Dashboard

- Loan Servicing

Top 9 Digital Mortgage Closing Software

1. Expedite Close

The Expedite Closing Network (eCN) from Black Knight is used to transfer loan packages and closing documents from lenders to settlement agents (B2B). Black Knight has annual revenue of $593.3 million and 4,092 employees.

2. DocuSign Rooms for Mortgage

DocuSign includes an electronic signature, workflow management, data validation, cloud storage integration, and more advanced features. DocuSign has annual revenue of $518.5 million and 3,558 employees.

3. Experian Mortgage

Experian Mortgage offers insights and analytics, improves marketing, and ensures customer engagement. It gives you the ability to make better decisions, reduce risk, and provide a frictionless customer experience. Experian has annual revenue of $151.5 million and 1,045 employees.

4. Snapdocs

Based on customizable preferences, Snapdocs’ artificial intelligence bots classify, annotate, and sort documents into wet and esign packages. Snapdocs has annual revenue of $66.4 million and 578 employees.

5. DocMagic

DocMagic is designed to help lenders, settlement service providers, investors, and borrowers advance through the mortgage process at every stage. Docmagic has annual revenue of $16 million and 110 employees.

6. AtClose

AtClose includes automatic title search, closing disclosure preparation, recording automation, automatic underwriter, and vendor management. AtClose has annual revenue of $13 million and 73 employees.

7. Cloudvirga Enterprise POS

To create underwriter-ready loans, Cloudvirga Enterprise POS includes directed workflows, calculates risk, and checks compliance. Cloudvirga has annual revenue of $9.1 million and 70 employees.

8. EClosePlus

EClosePlus or eMortgageLaw streamlines the real estate closing process for mortgage lenders, settlement agents, and borrowers by digitizing closing documents to allow for eSignatures and resulting in a more efficient and nearly error-free closing process. EMortgageLaw has annual revenue of more than $5 million and more than 25 employees.

9. MortgageHippo

MortgageHippo gives you the ability to make better decisions, reduce risk, and provide a frictionless customer experience with loan processing, online applications, and more. MortgageHippo has annual revenue of $4.2 million and 20 employees.

FAQs

Why is a mortgage important?

Not all people have enough savings to buy the house they need or want. Real estates are expensive, making it challenging to afford, especially when everything is not going your way. Mortgage serves as the savior of individuals that did not have the chance to save. It helps you buy the home you want, of course, with legal agreements.

Why is mortgage software beneficial?

Mortgage operations have critical procedures that require flawless management. Of course, if it involves money and other types of assets, it will need documentation and effective communication that manual processes may find challenging to meet. With software on hand, you can perform multiple tasks while ensuring quality assurance and customer satisfaction.

What is digital closing?

After a long procedure and critical process, mortgages settlement is the final part. The mortgage closing is the last operation that the lender and borrower will need to polish before ending the meeting. Closing is the part where all necessary documents are signed, and all policies, rules, and regulations are agreed upon.

As the world advances due to technology, new methods drive the market to have higher expectations. Such a situation can be a headache when you don’t meet your client’s expectations. That is why using digital mortgage closing software is the best choice. With this software as your technology partner, you can provide good customer service and build trust.

Related Posts

10+ Best Chemical Software for Windows, Mac, Android 2022

12+ Best Vulnerability Scanner Software for Windows, Mac, Android 2022

4+ Best Bundled Pay Management Software for Windows, Mac, Android 2022

10+ Best Trust Accounting Software for Windows, Mac, Android 2022

10+ Best Patient Portal Software for Windows, Mac, Android 2022

13+ Best Virtual Reality (VR) Software for Windows, Mac, Android 2022

12+ Best Bed and Breakfast Software for Windows, Mac, Android 2022

15+ Best Resort Management Software for Windows, Mac, Android 2022

14+ Best Hotel Channel Management Software for Windows, Mac, Android 2022

12+ Best Social Media Monitoring Software for Windows, Mac, Android 2022

10+ Best Transport Management Software for Windows, Mac, Android 2022

10+ Best Other Marketing Software for Windows, Mac, Android 2022

10+ Best Top Sales Enablement Software for Windows, Mac, Android 2022

8+ Best Industry Business Intelligence Software for Windows, Mac, Android 2022

10+ Best Insurance Agency Software for Windows, Mac, Android 2022