Transferring a large number of goods necessitates a variety of aspects that must be completed flawlessly, including taxes and billing systems. Knowing the flow of your goods is essential. Yet, because manual techniques are insufficient, you will require e-way bill software. You can continue reading to view our software recommendations and to learn more.

10+ Best E-Way Bill Software

1. Zoho Invoice

2. ClearTax

3. HostBooks GST

4. XaTTaX

5. Payswiff

6. GSTrobo

7. Horizon ERP

8. MARG ERP 9+ Accounting

9. Merrchant

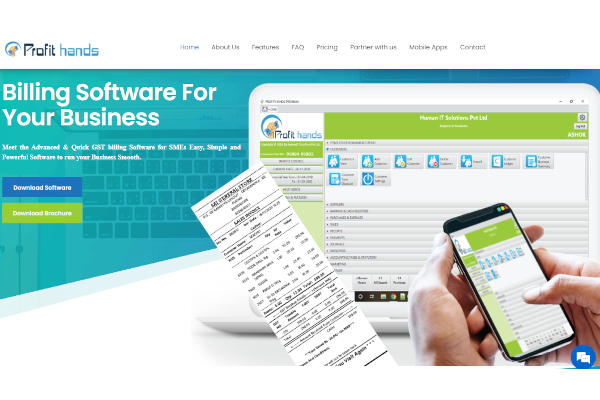

10. Profit Hands

11. QWay

What is E-Way Bill Software?

E-way bill software is a technological tool with multiple advanced features and functionalities, allowing you to perform your tasks and projects professionally and conveniently. As we all know, transporting goods requires essential elements such as invoices and other documentation for billing processes and communicating with business partners effectively. Using e-way bill software allows for more convenient methods of evaluating inventory, the number of supplies to be transported, taxes, and other factors. With this technology partner, you can solve your current complexities and ensure smooth sailing business operations.

Benefits

The business industry uses e-way bill software as it delivers impressive benefits and advantages to their daily operations. With this software, you can lessen your dependencies on actual papers that are prone to misplacements. E-way bill software also enables quick and reliable processes, accurate data analytics, seamless goods movements, faultless billings, tax compliance, etc.

Features

Features and functionalities are two elements you need to analyze before buying the software that caught your interest. Platforms deliver different performance and quality, which requires thorough research. Aside from differentiating in performance, they are also expensive. By researching, you can guarantee to avoid wrong investments in software. We prepared several recommended software for you below. If you need more details, the software comparison website is always available. You can also try free trials and versions to test them firsthand. Below are features you might need:

- Barcode / Ticket Scanning

- Discount Management

- Electronic Signature

- Email Marketing

- Inventory Management

- Inventory Optimization

- Manufacturing Inventory Management

- Merchandise Management

Top 10 E-Way Bill Software

1. Zoho Invoice

Zoho Invoice includes a billing portal, dunning management, contact database, project billing, online payments, and more advanced features. Zoho has annual revenue of $2 billion and 10,000 employees.

2. QWay

QWay includes an audit trail, GST compliance, GST returns, dashboard, compliance management, data validation check, invoice, and billing. QWay has annual revenue of $634 million and 3,000 employees.

3. HostBooks GST

HostBooks GST includes accounts receivable, fixed asset management, fund accounting, purchase order management, project accounting, and more innovative features. HostBooks has annual revenue of $26.6 million and 167 employees.

4. Payswiff

Payswiff includes accounting, compliance management, e-way bill generation, GST returns, data import/export, and more advanced features. Payswiff has annual revenue of $19.7 million and 243 employees.

5. Merrchant

Merrchant from Raletta includes customer relationship management (CRM), financial management, marketing automation, order management, and more innovative features. Raletta has annual revenue of $17.8 million and 223 employees.

6. ClearTax

ClearTax includes sales tax management, inventory management, address validation, reporting, transaction tracking, MIS reports, and more valuable features. ClearTax has more than $5 million in annual sales and more than 25 workers.

7. XaTTax

XaTTax includes email integration, purchase management, sales management, customer tracking, GST compliance, and more logical features. XaTTax has annual revenue of more than $5 million and 25 employees.

8. Horizon ERP

Horizon ERP includes cost management, fund accounting, inventory management, expense tracking, contact database, cost management, and more contributive features. Horizon Technology Solutions has annual revenue of more than $5 million and more than 25 employees.

9. MARG ERP 9+ Accounting

MARG ERP 9+ Accounting includes vendor management, warehouse management, financial accounting, accounts receivable, expense management, and more advanced features. Marg ERP has annual revenue of more than $5 million and more than 25 employees.

10. GSTrobo

GSTrobo includes accounting, reporting, collaboration, compliance management, dashboard, data validation check, maintain transporter data, and more valuable features. GSTrobo is easy to use and ensures security and reliability.

FAQs

Why are invoices important?

A receipt or an invoice is a piece of paper that serves as a confirmation or proof that a customer has purchased the product. An invoice is a document that shows the consumers their purchased goods and how much they cost. It also presents the VAT (value-added tax) to the item.

Why do you need invoice management?

Invoice management plays a critical role in the professional industry as it helps businesses know their cash flow and improve financial management. This practice also enables accurate billing processes leading to customer satisfaction. It also prevents possible disputes regarding payment issues due to poor-quality administration and inaccurate payment details. For this reason, invoice management is essential.

What is GST?

GST, or goods and services tax, is the tax requested by the government regarding the sales of goods and services. The tax amount is determined regarding the product’s price. GST is a matter the business industry needs to comply with because it is part of the law. It is also known as VAT, which stands for value-added tax on products and services.

As we all know, the business industry is getting busier and busier, given that the market’s demand increased. For this reason, manual methods are not reliable and practical enough to ensure reaching your goals. E-way bill software is one of the solutions you need to process, evaluate, monitor, understand, and make decisions effectively and efficiently.

Related Posts

10+ Best Chemical Software for Windows, Mac, Android 2022

12+ Best Vulnerability Scanner Software for Windows, Mac, Android 2022

4+ Best Bundled Pay Management Software for Windows, Mac, Android 2022

10+ Best Trust Accounting Software for Windows, Mac, Android 2022

10+ Best Patient Portal Software for Windows, Mac, Android 2022

13+ Best Virtual Reality (VR) Software for Windows, Mac, Android 2022

12+ Best Bed and Breakfast Software for Windows, Mac, Android 2022

15+ Best Resort Management Software for Windows, Mac, Android 2022

14+ Best Hotel Channel Management Software for Windows, Mac, Android 2022

12+ Best Social Media Monitoring Software for Windows, Mac, Android 2022

10+ Best Transport Management Software for Windows, Mac, Android 2022

10+ Best Other Marketing Software for Windows, Mac, Android 2022

10+ Best Top Sales Enablement Software for Windows, Mac, Android 2022

8+ Best Industry Business Intelligence Software for Windows, Mac, Android 2022

10+ Best Insurance Agency Software for Windows, Mac, Android 2022