Tax transactions have complex factors that require flawless procedures and documentation. It includes invoices, receipts, appointments, schedules, agreements, and more. Due to its multiple critical factors, manual processes are not enough. That being the case, you might need a solution such as GST reconciliation software. Continue reading below for more.

21+ GST Reconciliation Software

1. Zoho Books

2. EasyGST

3. TallyPrime

4. ClearTax

5. Marg GST Software

6. GSTHero

7. Cygnet

8. UBooks

9. Octa GST

10. XaTTaX

11. GST Edge

12. Quicksoft

13. LEGALRAASTA

14. Tax2win

15. SCIGST

16. MyGSTcafe

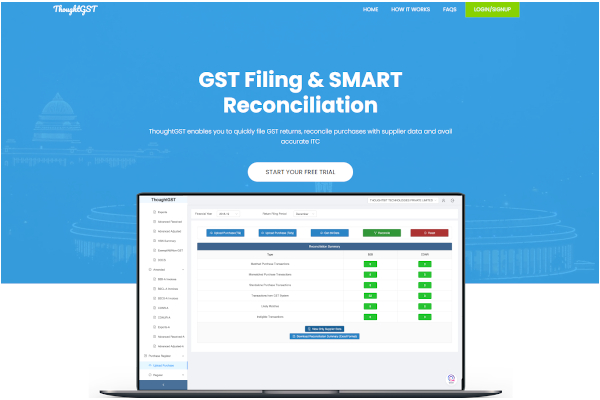

17. ThoughtGST

18. TaxPro GST

19. Masters

20. LEDGERS

21. SuperTax

22. RecoGST

What is GST Reconciliation?

In the modern era, the professional industry uses technological instruments to improve productivity and ensure quality assurance. However, although it provides enhancements, it also produces complexities that require innovative tools. GST reconciliation software is a technological tool made solely for taxation for goods and services. It offers advanced features and functionalities to assist you in invoicing, documenting, matching recipients. It permits one to ensure that no sales or purchases are missing from GST returns or are reported incorrectly.

Benefits

Traditional methods of recording and transacting tax of purchase and sales can result in multiple errors. Such issues hinder operation and can cause disputes which are frustrating and time-consuming. With GST reconciliation software on hand, you can reduce complexities. It has several advantages, including claiming the correct amount of input tax credit, avoiding notices and audit concerns, and handling the reconciliation process.

Features

Features and functionalities are aspects you need to analyze before buying the software you want. These two factors are the mechanics of the software to operate and work. However, although the software is contributive, it is not a bluff that several platforms provide weak tools. Therefore it is crucial to research to evaluate the software’s performance and capabilities. That way, you can avoid investing in irrelevant tools. You can read user reviews to gather data or try free trials to test them firsthand. The following are features you might need:

- Address Validation

- Consumer Use Tax

- Exemption Management

- Taxability Verification

- Transaction Tracking

- Value Added Tax (VAT)

- Business Dashboard

Top 10 GST Reconciliation

1. Zoho Books

Zoho Books from Zoho Corporation includes accounting, invoice management, contact management, and more advanced features. Zoho Corporation has annual revenue of a billion-dollar and 7023 employees.

2. TallyPrime

TallyPrime from Tally Solutions includes distribution management, enterprise asset management, supply chain management, and more innovative features. Tally Solutions has annual revenue of $264.9 million and 1,827 employees.

3. Cygnet

Cygnet Infotech’s Financial Accounting Software is built on cutting-edge technologies to meet the needs of today’s accountants. Cygnet Infotech has an annual revenue of $152.1 million and 1,134 employees.

4. ClearTax

ClearTax includes sales tax management, inventory management, tax management, reporting, and more advanced features. ClearTax has annual revenue of $108.9 million and 1,033 employees.

5. Tax2win

Tax2win encourages consumers to file their income taxes early to expedite the refund process. It has a user-friendly, rapid, and easy-to-use interface for submitting taxes. Tax2win has annual revenue of $10.9 million and 102 employees.

6. EasyGST

EasyGST from Whiz Solutions includes accounts receivable, expense tracking, payroll management, and more valuable features. Whiz Solutions has annual revenue of $10 million and 64 employees.

7. UBooks

UBooks includes dashboard, GST return, reporting, data import, payment management, managed infrastructures, and more advanced features. UBooks generates more than $5 million in annual revenue and employs more than 25 people.

8. Marg GST Software

Marg GST Software includes barcode management, GST billing, and returns filing, inventory management, and more logical features. Marg employs around 25 people and generates over $5 million in annual revenue.

9. GSTHero

GSTHero includes GST compliance, reporting, document printing, data security and accuracy, e-payment, and more innovative features. GSTHero is a GST reconciliation software that runs on the cloud.

10. Octa GST

Octa GST includes tax management, GST returns, accounting, invoices, GST audit reports, and more innovative features. Octa GST is an offline return filling and reconciliation software for all types of businesses and tax experts that is straightforward to use.

FAQs

Why is tax important?

The world requires the government. They offer public servants, environment development, and more. Paying tax is law, as the government needs financial support to give salaries to public servants such as the police organization, firefighters, and other government members. Tax is one of the most crucial elements to run the world as it assists in the industry’s improvement.

Why is tax management crucial?

Proper tax management assists the professional industry and you as an individual. Finance teams can use accurate tax management to assess and arrange tax-related aspects such as documentation, payments, invoices, payers, and more. Tax planning, as an individual, helps you in financial planning and forecasting your budget. It ensures boosted budgeting and forecasting, leading to a better understanding of your finances.

Why do you need software?

As the world advances with technology, it is natural for the professional industry to adapt. Companies, regardless of the size, use software to enhance business-critical factors. The software provides multiple features and functionalities, allowing users to gain insights and a complete understanding of their business system. With this tool, firms reach good customer service, acquire customer satisfaction, and ensure operational efficiency.

Ensuring match recipients and documents can be challenging. Discrepancies arise due to multiple complaints, a frustrating event that can sully your company’s reputation. Since we live in the modern era, you need to adapt to technology. With GST reconciliation software, you can guarantee accurate data and boost productivity, leading you to acquire customer satisfaction.

Related Posts

10+ Best Chemical Software for Windows, Mac, Android 2022

12+ Best Vulnerability Scanner Software for Windows, Mac, Android 2022

4+ Best Bundled Pay Management Software for Windows, Mac, Android 2022

10+ Best Trust Accounting Software for Windows, Mac, Android 2022

10+ Best Patient Portal Software for Windows, Mac, Android 2022

13+ Best Virtual Reality (VR) Software for Windows, Mac, Android 2022

12+ Best Bed and Breakfast Software for Windows, Mac, Android 2022

15+ Best Resort Management Software for Windows, Mac, Android 2022

14+ Best Hotel Channel Management Software for Windows, Mac, Android 2022

12+ Best Social Media Monitoring Software for Windows, Mac, Android 2022

10+ Best Transport Management Software for Windows, Mac, Android 2022

10+ Best Other Marketing Software for Windows, Mac, Android 2022

10+ Best Top Sales Enablement Software for Windows, Mac, Android 2022

8+ Best Industry Business Intelligence Software for Windows, Mac, Android 2022

10+ Best Insurance Agency Software for Windows, Mac, Android 2022